The secondaries market has become an increasingly important part of the private equity ecosystem. This article answers:

- What are secondary investments?

- Why are they attractive?

- What returns have they delivered?

- Where do they fit within our investment strategy?

Secondary investments can be broadly split into two categories: LP Secondaries and GP Secondaries. At ICG Enterprise Trust, we invest in both LP and GP secondaries.

ICGT Portfolio by investment type (as at 30 April 2023)

Chart source: Preliminary results for the 12 months ended 31 January 2023

In this article we provide a brief introduction to LP Secondaries.

What are LP Secondaries?

LP Secondaries are investments in which an investor in a private equity fund (also known as a Limited Partner, or ‘LP’) sells their stake in one (or more) fund(s) to another investor before the end of the fund life. The seller will select a range of funds they have interests in, and buyers will bid on that portfolio, with prices expressed as a percentage of Net Asset Value (‘NAV’).

There are a number of reasons LPs might sell, including:

- Portfolio reweighting

Investors typically maintain target and/or maximum weightings for different asset classes as a portion of their total portfolio. If an investor’s total portfolio value decreases due to certain asset classes underperforming, the investor may need to sell a portion of the outperforming asset classes to reweight their portfolio and in line with their target asset allocations. This is called the ‘denominator effect’, and has been a key driver of LP Secondary transactions recently.

- Changes to investment mandate

An LP’s investment mandate may change over time, driven by a change in strategy, or a change in market regulation. An LP may therefore need to sell all or part of their PE investments sooner than originally anticipated.

- Cashflow requirements

Private equity is, by nature, a long term investment (the average fund life of a fund is c.10 years). Since the exit of investments in a fund is controlled by the fund manager, this can create a liquidity problem for an LP if their circumstances change. Changes in an LP’s financial circumstances may mean they need cash in the near-term, and selling a portfolio of their private equity investments through a secondary transaction can help them achieve this.

Over the last 12-18 months, we have seen some attractive investment opportunities in the secondary market, driven in part by evolving supply/demand dynamics. Historically, portfolios of buyout fund interests have traded at only a small discount to NAV. However, due to the reasons mentioned above, increased supply has driven secondary market discounts wider in the last year, enabling secondary investors to purchase attractive portfolios at compelling discounts to their NAV.

Secondary market pricing of LP portfolios (% of NAV) 1

Chart source: Global Secondary Market Review, Jefferies (January 2023). Data is based on transactions executed by Jefferies’ Private Capital Advisory team and public non-Jefferies transactions

What makes LP Secondaries an attractive investment? 1

LP Secondary investments can have a number of attractive characteristics:

- Diversification

Unlike investing into a single company or even fund, one LP Secondary transaction is typically comprised of stakes in multiple funds. This portfolio diversification reduces the risk of a single investment negatively impacting returns. For example, ICG Enterprise Trust’s secondary investment in Ludgate Hill I in 2021 gave it exposure to over 90 underlying funds and around 600 underlying companies.

- Known set of underlying companies

In a Primary fund, an investor makes a Commitment to a fund which will then invest in companies that have not yet been identified. In an LP Secondary transaction, an investor has greater visibility, and fewer unknown variables, as the underlying funds are typically either close to or fully invested by the time of a secondary transaction. This means that a secondary investor can do their own analysis on the underlying companies and make an offer that reflects their fair value.

- Speed of cash return

Fund interests in LP Secondary transactions are generally at least 3-5 years into their investment period; as a result, the underlying investments are typically closer to exit. This means proceeds are returned to the investor more quickly, helping with cashflow management and also supporting IRRs.

What does this mean for returns?

Secondaries offer an attractive risk/return profile relative to other asset classes.

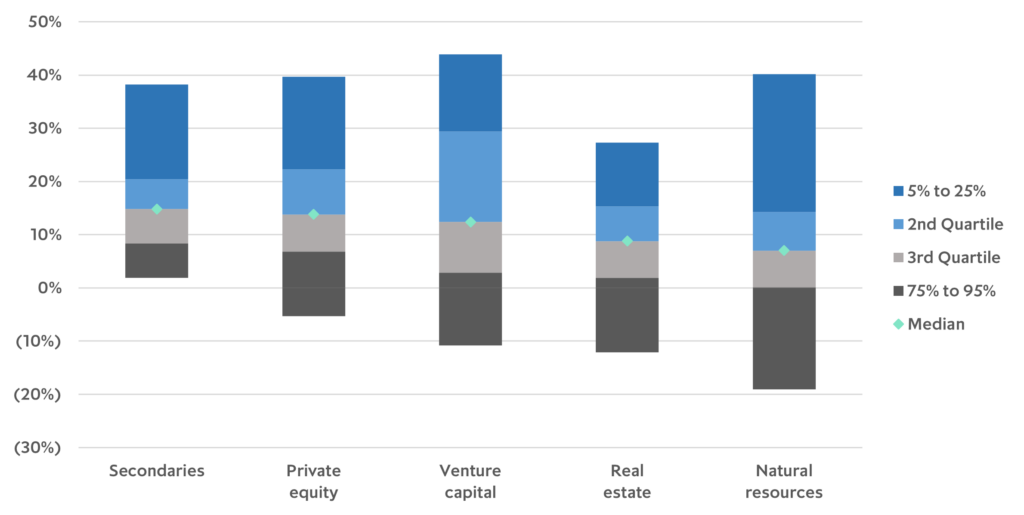

Dispersion of returns, by asset class (2000-2019 vintage funds) 1

Chart source: Cambridge Associates LLC, Streamlined private investing: uncovering growth in secondaries (May 2023).

Notes: Data reflects pooled fund returns for 2000-2019 vintage funds of each respective asset class, as at 31 December 2022. Pooled returns are net of fees, expenses and carried interest. Funds less than three years old are considered too young to have produced meaningful returns, and so are excluded from this analysis. Private equity includes buyout and growth equity funds. Natural resources includes private energy, energy upstream & royalties, and timber funds. All asset classes listed are global.

Secondary funds have historically delivered lower loss rates and lower dispersion of performance when compared to other alternative asset classes.2 They also have a quicker cash return profile – as expected, given the portfolios are mature.

As an example from the ICG Enterprise Trust portfolio, our LP Secondary investment ‘ICG Ludgate Hill I’ has generated an IRR of >70% and a DPI of 80% for ICG Enterprise Trust within 1.5 years. 1, 3

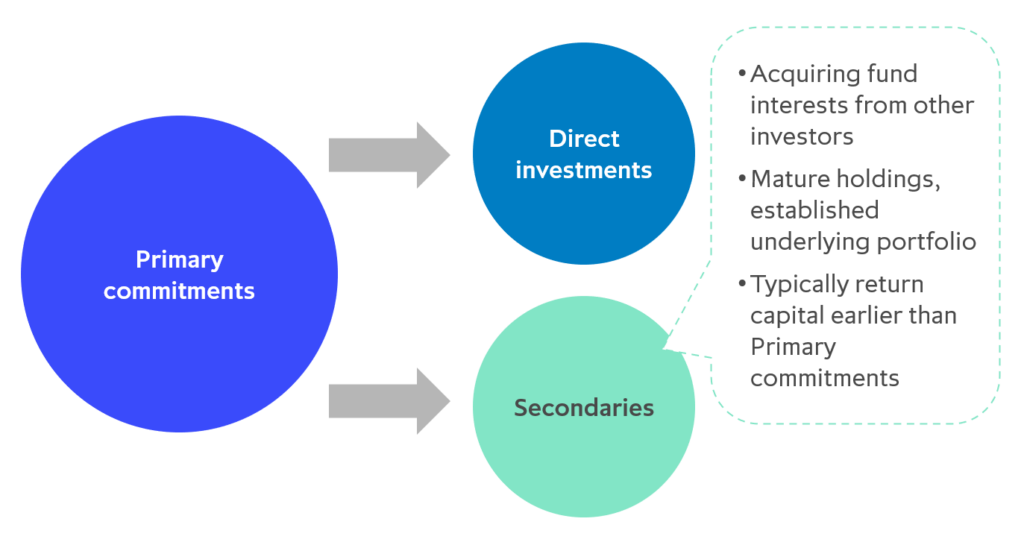

How do LP Secondaries fit in ICG Enterprise Trust’s Portfolio?

Investing in secondaries is a key part of how we access the private equity market:

Chart source: ICG Enterprise Trust Investor Day 2023

We target having approximately 25% of our Portfolio in secondary investments over the medium term.4

Our longstanding Primary relationships are a vital asset to our LP Secondaries programme, providing us with a deep knowledge base of the performance and strategy of those fund interests which may form part of a secondary portfolio. On top of this, our existing Primary commitments can offer us unique access in certain secondary transactions, particularly in cases where a GP might restrict the transferral of an LP’s interest to existing investors in the fund, or to otherwise known investors.

From a financial perspective, LP Secondary investments enhance our Portfolio diversification and can provide efficient capital distributions that can support our cashflow management and capital allocation. Our LP Secondary investments have historically demonstrated an attractive risk-adjusted returns profile that is well-aligned to our investment strategy.

ICG Enterprise Trust seeks to deliver compounding capital returns for our shareholders over the long term. LP Secondary investments help us achieve this through their lower risk profile, higher IRRs, quick cash return profile and the differentiated insight they give us on the performance of the global private equity market 5.

Go deeper

- See an unfamiliar term in this article? See our Glossary for explanations of some key terms.

- The article references a number of topics that we covered in more depth in our Investor Day in June 2023. Presentation materials and a replay of the event can be found here.

References

[1] Past performance cannot be relied on as a guide to future performance. There is no guarantee that an individual investment or investment strategy will achieve its objectives or avoid substantial losses

[2] Source: CAIS, The evolution of the private equity secondary market (September 2022); Preqin data, net multiple taken from mature primary buyout, venture and secondaries funds with vintages from 2000-2017, as of each fund’s last reporting date

[3] Source: ICG Enterprise Trust Investor Day 2023; data as at 31 December 2022 (original investment made in 2021). ‘IRR’ is an abbreviation for Internal Rate of Return; ‘DPI’ is an abbreviation for Distribution to Paid-In Capital, a measure of capital returned to an LP relative to the amount they have invested

[4] ICG Enterprise Trust Portfolio composition targets as disclosed in the Company’s FY23 results materials (available here)

[5] Comparatives are based on the typical financial profile of LP Secondary investments when compared to Primary investments; cf: The evolution of the private equity secondary market CAIS (September 2022)

Back

Back